Matt Knoll, CFP®, Sr. Financial Planner, Illinois

It’s easier now than it’s ever been for people to play the stock market. Simply download an app and you can buy and sell stocks from your smartphone. The plethora of financial news programs on cable provide a steady stream of real-time updates that make us all feel like experts. Then there are the commercials extolling the rewards of day-trading. While there’s plenty of evidence that it’s become easier for people to play the stock market, the real question is whether it’s a good idea.

The Neuroscience Behind Investing Money

The answer, surprisingly, can be found in human in biology, and more specifically, the study of the human brain. Consider research conducted by the neuroscientist, Hans Breiter MD, at Massachusetts General Hospital. He demonstrated that people who received a monetary reward from a profitable financial gamble, such as scoring big on an investment, had very similar brain activation as a drug addict receiving an infusion of cocaine. MRI scans showed similar neurons firing in both cases. The research proved that monetary rewards tap into the same system in the human brain that processes other categories of rewards, for thing such as drugs and food.

What that tells us is that even when we think we are in control and exercising good judgement, our behavior and our choices are influenced by natural tendencies. When the market goes up and things look good, the neurons in our brains fire off messages to buy. When the market drops, losing money activates the same part of our brain that responds to mortal danger. A down market triggers a fear response and our neurons fire off messages to sell.

We think we’re being rationale when we’re really responding to the hard wiring in our brains. Let’s look at how the impulse to react to market changes can affect our investments.

Cost of Trying to Play the Market

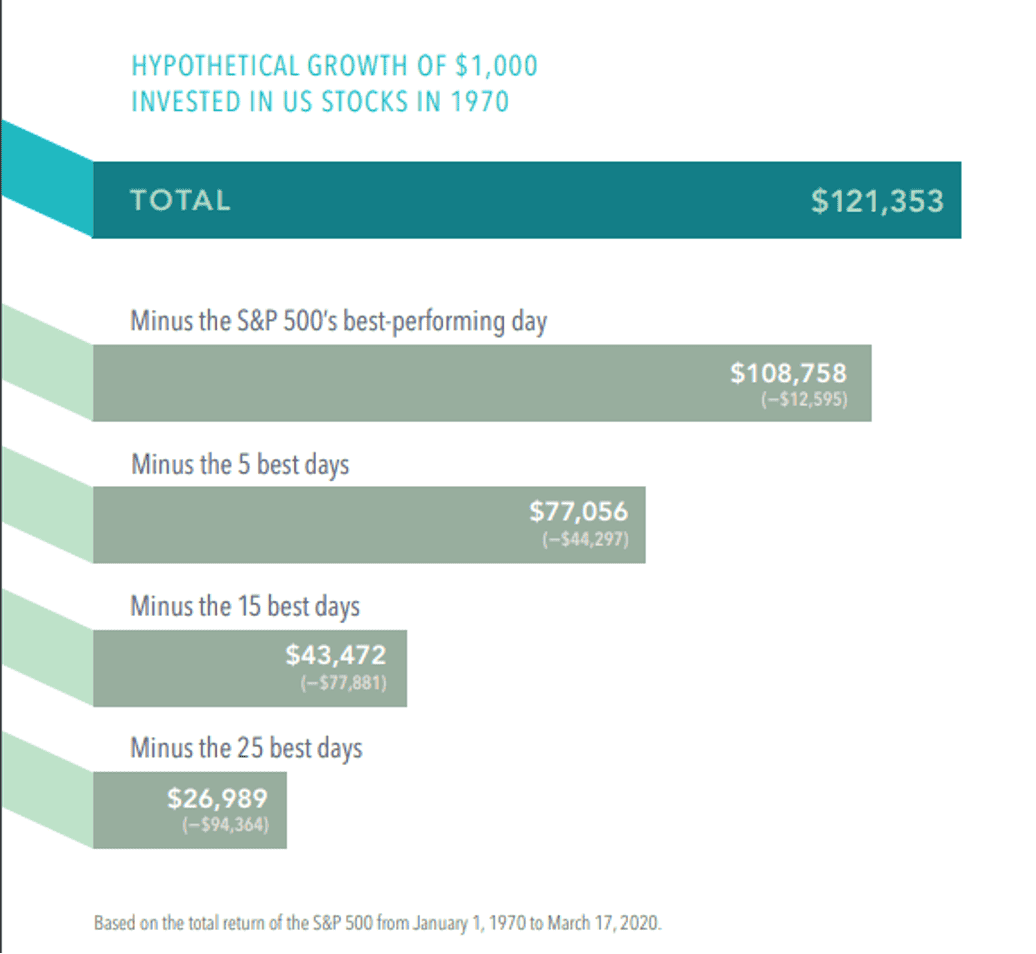

In 1970, if you had invested $1,000 in the S&P 500 and left it alone for 50 years, your investment would be worth $121,353. We all know that from 1970 to 2020, the market had plenty of ups and downs, so let’s say that instead of leaving the money alone, you tried to play the market. If you’re timing was off and you missed the single best performing day, you would have lost $12,595. If, over 50 years, you missed the best 25 days, your total investment would have only grown to $26,989. That’s almost $100,000 less than if you’d left the money untouched.

The impulse to buy when times are good and sell when times are bad is not only difficult to overcome, it can also be very costly.

Systems vs. Emotions

The truth is that humans aren’t naturally good at investing. To be successful, we need systems in place to override our impulses so we’re not reacting to whatever our neurons tell us to do at any given moment.

A better approach is to create a model portfolio that is balanced and reflects your goals. Then conduct regular reviews to reposition as circumstances change, with decisions to buy and sell based on systems and processes, not emotions.

The stakes are high so it’s important to make investment decisions that allow you to achieve your retirement goals. If you’d like to learn more about the principles behind behavioral finance, check out my webinar, Your Money, Your Mind and Your Investments Methods. It’s part of TPC’s series, Expedition to Retirement which brings together a diverse array of experts who help simplify and clarify the journey to retirement.

As our life expectancy grows, effective planning for retirement has never been more important. Our webinar series shows it can also be fun. If you have questions about any of the webinars, please, contact your TPC team.