By Matt Knoll, CFP® & Caleb Arringdale, EA

What is Cost Basis?

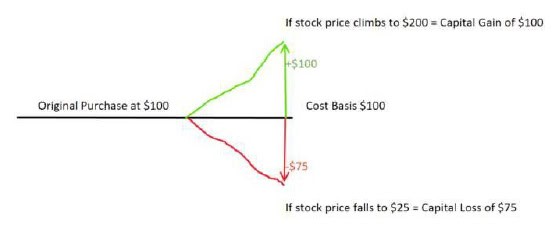

Cost basis is the original value of a share of stock. Because stock prices go up and down frequently, you can use your stock’s cost basis to help determine if there is a gain or loss upon selling that stock. Mutual funds, ETFs, bonds, and real estate use cost basis in the same way.

Why is it important to know your stock basis?

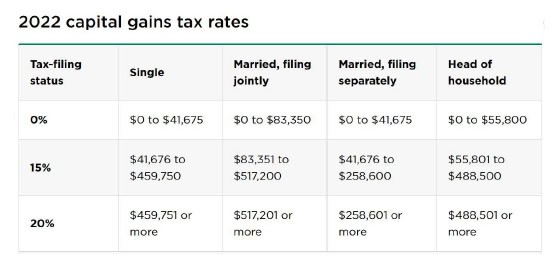

It’s important to know your cost basis in a stock for tracking and determining the capital gain or capital loss when the stock is sold. The capital gain or loss has important tax implications, as you will have to pay tax on the capital gain or receive a tax deduction for a capital loss. Below is a tax table of the capital gains rates depending on your taxable income and filing status:

https://www.irs.gov/taxtopics/tc409

These capital gains rates only apply to stocks that have been held longer than 1 year. If you sell a stock before holding it for 1 year with a gain, you will pay the tax on the gain at your ordinary income tax rate.

You can also use any capital losses to offset capital gains. If your total losses are more than your total gains for the year you can only deduct up to $3,000 of loss on your tax return and the balance carries forward each year until it is used up.

Who tracks the cost basis?

You, the taxpayer, are ultimately responsible for tracking the cost basis on a stock or investment. But you’re not alone when it comes to trying to record-keep and track the history. The Emergency Economic Stabilization Act of 2008 requires brokerage firms, mutual funds, and other institutions to track your cost basis if the investment was purchased after the following dates:

- Equities (stocks, including real estate investment trusts, or REITs) acquired on or after January 1, 2011

- Mutual funds, ETFs, and dividend reinvestment plans acquired on or after January 1, 2012

- Other specified securities, including most fixed-income securities (generally bonds) and options acquired on or after January 1, 2014

https://www.schwab.com/resource-center/insights/content/save-on-taxes-know-your-cost-basis

What if I didn’t buy the stock?

One of the more complicated basis issues can arise when stock is inherited or gifted, rather than purchased. When stock is gifted, the basis of the person who receives the stock is the same as the basis of the person who gifted the stock. In practical matters, that can mean that if you are gifted stock from a parent or grandparent, your basis could be very, very low.

If you inherited the stock, your basis is usually the value of the stock at the date of death of the person you inherited it from. That means that that, even if their basis was very low, your basis starts quite high. That can be very beneficial for you, letting you sell the stock with minimal to zero gain.

How do I minimize capital gains tax?

Sometimes paying the capital gains tax on a stock now isn’t always a bad thing. By avoiding the capital gains tax, you can often be pushing the tax down the road or even letting it snowball into a larger tax complication. But there are times when we want to be conscious of realizing capital gains tax and strategize on the best ways to minimize those taxes.

- Using qualified retirement accounts like 401k, IRA, or Roth accounts shelter stocks and other investments from any capital gains tax when the asset is sold. These accounts can have a huge advantage on avoiding taxes on investment earnings and are some of the best vehicles to save for retirement.

- Holding on to an asset for a year or longer qualifies you to pay tax at a lower capital gains rate, rather than your ordinary income tax rate.

- Tax loss harvesting is a process in selling stocks to strategically capture a capital loss to offset against any capital gains you may have throughout the year. Any of the losses resulting from this strategy that are excess of the $3,000 loss per year limit can roll into the next year.

- Speak with your CERTIFIED FINANCIAL PLANNER® about a plan that’s right for you

Matt Knoll, CFP®,, is a Sr. Financial Planner in the Quad Cities office of The Planning Center, a fee-only financial planning and wealth management firm. Email him at mattk@theplanningcenter.com.

Caleb Arringdale is a Tax Advisor in the Quad Cities office of The Planning Center, a fee-only financial planning and wealth management firm.

Please email Caleb at: caleb@theplanningcenter.com.