As financial planners, we spend a lot of time talking with our clients about risk. In the markets, as in life, accepting certain calculated risks is an essential component of growth and progress. To achieve desired outcomes, we must be willing to embrace uncertainty and accept the possibility that things won’t go exactly according to plan.

Every investor understands the risk-reward tradeoff on some level, yet it can be difficult to determine exactly how much risk is appropriate to accept in our portfolios. Complicating matters further, the risk-reward calculation is sensitive to many variables and is bound to change as our circumstances and attitudes evolve over time.

In this post, my hope is to simplify and clarify the risk-reward decision making process by introducing a three-question framework that can be adapted to any investment decision.

Question 1: How much risk can I tolerate?

Most everyone reading this is likely familiar with the idea of a risk tolerance questionnaire. Some are more in-depth that others, but each one has a shared goal– to determine how much risk an investor is comfortable taking with their portfolio.

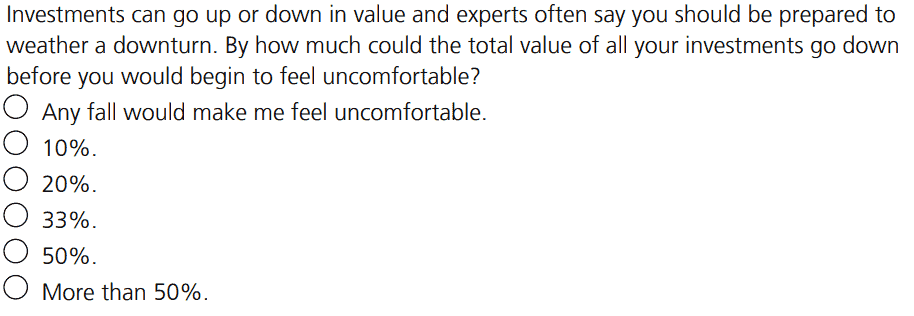

Here’s an example of a question from the FinaMetrica questionnaire we use at The Planning Center—

Questions such as this are important to ask. Investors who take on more risk than they’re comfortable with set themselves up for undue stress and worry when markets become volatile. In periods of extreme volatility, this anxiety can lead to poor decisions and unfavorable outcomes, such as selling investments at a loss.

Question 2: How much risk do I need to accept?

In a perfect world, we’d all be able to invest exclusively in low-risk assets (i.e., CDs and money market accounts) and have more than enough money to fund all our financial goals. As it turns out, most of us are not so fortunate.

For better or worse, most people need to save and participate in the stock market for multiple decades to generate the wealth needed to fund major financial goals, such as a multi-decade retirement. This leads to a question- how much risk do you need to take, and how does this compare with the level of risk you’re comfortable with?

If these two questions are aligned, great! You’re well on your way to determining how much risk is appropriate for your portfolio.

If not, you’ve got three choices.

- Spend less. If you have a relatively low tolerance for risk paired with a relatively high need for returns, one option is to spend less moving forward. This could involve finding ways to reduce discretionary lifestyle expenses or simply retiring a few years later, thus reducing the total amount needed to fund retirement. The less you spend in the future, the less risk you need to take to fund those expenses.

- Save more. If you have some time before you retire and have a relatively low tolerance for risk, consider ramping up your savings. The more you save today, the less risk you need to take with your investments both now and in the future.

- Adjust your mindset. If you are unable or unwilling to spend less or save more, you may need to become more comfortable with risk. This can be difficult, though, as our attitudes about risk are often deeply embedded and stem from years of personal experience. Rewiring our brains to be more tolerant of risk isn’t easy, but it is possible. In my experience, taking the time to educate oneself about the innerworkings of markets and investing is a good way to become more comfortable with risk. After all, risks we understand are often much less anxiety-inducing than those we don’t.

Question 3: How much risk is my financial plan able to sustain?

Investors who are willing to accept risk in their portfolios generally do so with the expectation that their long-term returns will be positive. This expectation is reasonable. After all, why would anyone be willing to accept risk if there weren’t a benefit to doing so?

That said, while risk and return are generally positively correlated over extended time horizons, there is a point at which too much risk could seriously jeopardize the long-term viability of your plan.

That’s why most retirees are not comfortable with extremely aggressive portfolios. The possibility of achieving outsized investment returns simply isn’t worth the risk of losing a large portion of their hard-earned savings in a market downturn, especially when such losses could lead to significant lifestyle and spending sacrifices.

Every person has a ceiling for how much risk they can reasonably accept. For the ultra-wealthy, this ceiling is often very high. After all, a multi-billionaire who loses 50% of her net worth on a speculative investment is still a billionaire!

For the rest of us, a 50% loss could be potentially devastating, so we need to do everything we can to avoid that outcome. We do this by designing a portfolio that properly balances risky (i.e., stocks) and conservative (i.e., bonds and cash) assets.

—

So, how much risk should you be taking in your portfolio? It depends! On your timeline, goals, and financial resources, among other factors. Ultimately, the answer is going to lie at the intersection of the three questions discussed above.

It takes time to properly address each of the questions, but it’s worth the effort. Not only will your investment strategy be one you’re comfortable with in times of volatility and uncertainty, it will also be designed to achieve the returns needed to achieve your most important financial goals. Questions? Contact TPC, we can help you explore these questions and more.