By Matt Knoll, CFP ®, Sr. Financial Planner Kids build their foundational skills and habits for life as they grow up, and as a parent or grandparent, we play a big role in helping them learn and develop. Talking to kids about money to help them create good money habits can make a big impact on the way they think about spending and saving for the rest of their life.

Kids build their foundational skills and habits for life as they grow up, and as a parent or grandparent, we play a big role in helping them learn and develop. Talking to kids about money to help them create good money habits can make a big impact on the way they think about spending and saving for the rest of their life.

Unfortunately, one or two conversations about money lessons does not always stick in a young person’s mind. But having continuous dialog around money and mixing in real-life experiences can help instill good money habits as they grow up.

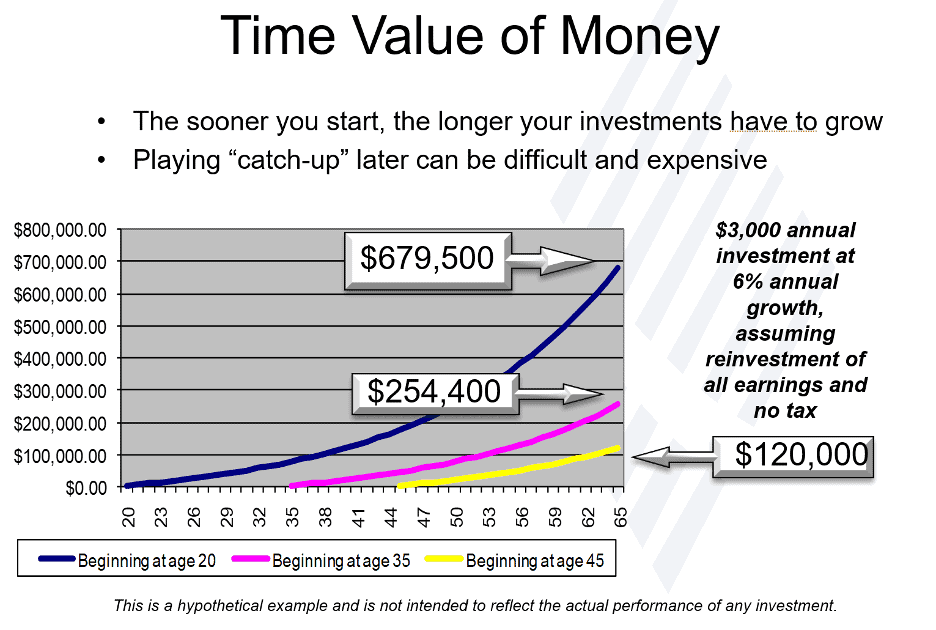

One concept worth sharing is the idea of saving and compound interest. The value of not spending money and saving it for the future teaches a benefit of holding onto your money until something really good comes along rather than just buying the first neat thing you see. A trickier concept is compound interest.

What is compound interest?

When you put your money into a savings account, it grows and earns money called interest. The interest is added to the balance of the savings account. As the balance of your savings account gets bigger and bigger, it earns more and more interest and continues to grow, like a snowball rolling down a hill.

Compound Interest Games for Kids

Younger Children:

To demonstrate compound interest, play “The Marshmallow Game”:

- Stage 1: Give your child a single marshmallow, tell them that they can restrain from eating the marshmallow now, they will receive another marshmallow after 5 minutes.

- Stage 2: If your child was able to hold off for the 5-minute time period and still have the original marshmallow, reward them with a second marshmallow.

- Stage 3: Now up the challenge and the reward, if your child doesn’t eat these two marshmallows for another 5 minutes you can add two more.

- Stage 4: If they are able to hold off again, they will now have 4 marshmallows. Use this experiment to relate to the concept of compound interest. If you are able to not spend your money and save it, you will be rewarded with more money as it grows.

Older Children:

Show them the easy-to-understand visuals by giving them a little money to experiment with and have the conversations around money lessons and mistakes. If you give your child an allowance or if they receive money from a birthday or holiday gift, explain the value of saving vs spending and watch what decisions they make. This can let kids have money experiences and hopefully learn good habits.

Saving early and the power of compound interest are great lessons that can be applied at any age. Research shows the earlier you start talking about money with your kids, the better! According to a 2013 study performed by behavior experts at Cambridge University, money forming habits can be set as early as 7 years old. It can be hard to reverse those habits later in life.

For more tips for your children around money stay tuned to the TPC blog or contact your TPC planner.

Matt Knoll, CFP®,, is a Sr. Financial Planner in the Quad Cities office of The Planning Center, a fee-only financial planning and wealth management firm. Email him at mattk@theplanningcenter.com.

Matt Knoll, CFP®,, is a Sr. Financial Planner in the Quad Cities office of The Planning Center, a fee-only financial planning and wealth management firm. Email him at mattk@theplanningcenter.com.