by Andrew Sivertsen, CFP®, CeFT®

To say these are unique times would be an understatement. Like most of you, I’m currently writing this article and watching a late spring snow melt from my makeshift office and following the current stay at home orders instituted by my state.

I haven’t driven anywhere but the grocery store in over a month and personal and professional zoom calls seem the new way of life. As a parent of three young children I’m also balancing shifts with my wife Amy to cover parenting duties and oversee remote learning provided by our school district. I’m surrounded by thousands of legos, Mr. Potato Head, and a rocking horse that is sitting next to me where my three-year-old likes to rock and watch me work.

The initial shock of having to cancel our spring break trip, setup our office for remote work, and mourn the loss of school/childcare is beginning to wear off. Now the uncertainty is beginning to build. How long will this last? What does this mean for my family and friends personal health? What will happen to the economy and my local community and friends who own affected businesses? Should I have seen this all coming and been more prepared? Is there anything I should be doing with my investments?

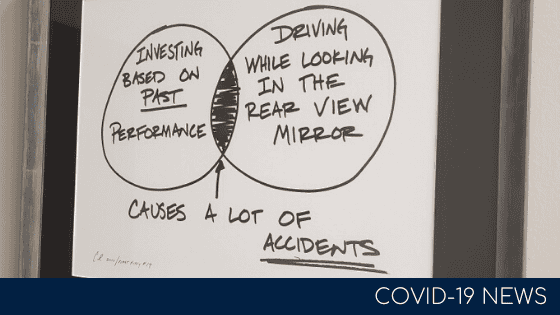

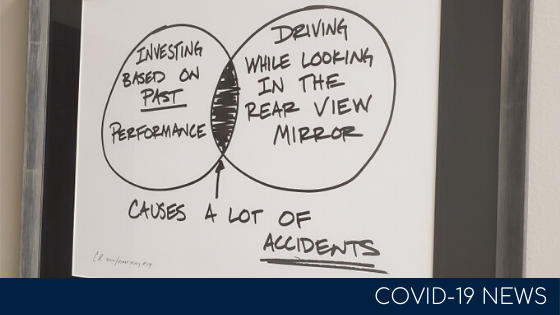

In our Moline office, we have a cartoon drawing framed from Carl Richards who writes for the New York Times. It creatively explains a psychology term called hindsight bias that explains our tendency as people to overestimate our ability to have predicted an outcome that could not have possibly been predicted.

It’s an important concept to understand to stick to a sound long term investment strategy. So how does this relate to the last three months and the foreseeable future?

It seems obvious now that COVID-19 was going to make a profound impact on stock markets, the economy, and our very way of life. I was reading the news in January and February with stories coming out of China and could see how bad it was. I had friends living over there sharing posts on Instagram. Should I have done something different with my investment strategy? What about all the projections about what countries or sectors of the economy will come back and in what order? Should I be doing anything different in the coming days with my investments? The answer is no.

Thinking in Bets

Annie Duke, a professional poker player, has a book called “Thinking In Bets”. She talks about a term called resulting that relates well to investing. She explains when you’re playing poker that there are hundreds of possible outcomes and you’re trying to make a decision based on the likelihood of a positive or negative result. However, once the cards are played our minds become fixed on the result and think that it was skill instead of luck that the hand was won. We begin to convince ourselves that the result was obvious, and we should have known that this was the only outcome.

The same thing happens with investing. Because of everything we now know about how quickly COVID-19 spread and the subsequent stay at home orders put in place by most states and many countries worldwide, it seems obvious that we should have sold everything out of the stock market in February. The reality is that two months ago we didn’t know that this would be the outcome. The prudent thing to do is remain invested in a diversified portfolio that is risk-adjusted to meet your long-term financial goals and risk tolerance.

The Future

Same thing goes for the future. Like many of you I’m having numerous conversations with family, friends, and neighbors. When do you think it will be safe to go back out? When will restaurants, gyms, and schools open back up? Will people go back out when things do open? Will there be a second wave of infections? Is March 23rd the bottom of the stock market drop, or will it drop further? There are so many unknowns and ways that this could play out. It will be easy in six months to look back and say that it was obvious how life, the economy, and stock markets will play out. But for now it’s just a guess and making an investment decision that goes outside of the long-term plan is dangerous. This is why it is important to stick to the academic principles that we’ve shared in recent articles around building the portfolio and then implementing the rebalancing and market pricing adjustment strategies to take our emotions and guesses out of the equation.

What is Important?

What is really important to do right now if you haven’t already is to meet with your planner and review your cash flow, cash reserves, and any opportunities to restructure debt with low interest rates. If your job is impacted, meet with your advisor to review your unemployment options or business options available under the CARES Act. Review your long-term financial projections to see if you are still ok, or is there anything to be done like reducing or suspending withdrawals from a portfolio. Most importantly take a breath and make sure that you are caring for your personal well-being. Stay connected with family and friends at a safe distance. Reach out to and help neighbors and those most affected. We will get through these uncertain times together. And yes in the end the result WILL seem obvious.

Andrew Sivertsen, CFP®, CeFT®, is a Sr. Financial Planner in the Quad Cities office of The Planning Center, a fee-only financial planning and wealth management firm. Email him at andrew@theplanningcenter.com.