By Cicily Maton, Retired Sr. Financial Planner

Cicily Maton has retired, however, Michelle Maton CFP®, EA, CeFT® Sr. Financial Planner and Andy Baxley CFP®, CIMA®, CeFT® Sr. Financial Planner carry on her legacy in the Chicago office.

One day any one of us could face the sobering reality of having to choose how much—or how little—medical treatment to undergo. If you or someone you love is too sick or incapacitated to decide their fate, what happens next? Hopefully, among the many legal papers tucked away for every eventuality, there is an Advance Directive advisory.

Advance directives are not legal documents, but they provide guidelines to the individual who has been named as your designated decision maker in the Health Care Power of Attorney. An Advance Directive isn’t just for the elderly or infirm; it’s a document for anyone who wishes to spell out their wishes in the form of clear, succinct instructions should they be unable to make their own health care decisions. The document can cover an infinite variation of possible situations, and still be as simple or as complex as desired.

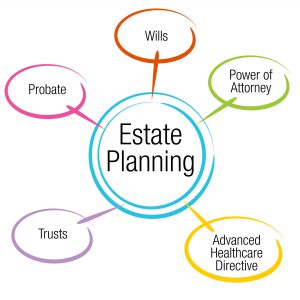

A Health Care Power of Attorney allows you to designate someone else to make medical decisions when you cannot. It is an essential part of your estate plan, along with your will, trust, and Power of Attorney for Property. The Advanced Directive does not take the place of a Power of Attorney for Health Care, but it can guide others in understanding the types of life-sustaining procedures a person may or may not want. That is why an Advance Directive should be added to any list of important estate documents.

An experience some years ago with a client who was single and without any living relatives led me to explore how she might ensure that her wishes and preferences be known and honored if such a situation were to arise. I discovered there are a number of organizations that have developed Advanced Directive documents. The Planning Center now has a worksheet that allows you to express your views on various medical treatments, and even provides an area to outline personal wishes for funeral services.

An experience some years ago with a client who was single and without any living relatives led me to explore how she might ensure that her wishes and preferences be known and honored if such a situation were to arise. I discovered there are a number of organizations that have developed Advanced Directive documents. The Planning Center now has a worksheet that allows you to express your views on various medical treatments, and even provides an area to outline personal wishes for funeral services.

Granted, having such a conversation with a loved one about filling out an Advanced Directive may not be easy. However, it is becoming more necessary as an increasing number of families find themselves in disagreement (or even conflict) over a loved one’s medical preferences when the prognosis is life threating. Decisions about medical issues, if made in times of crisis, emotional stress, or emergency, can lead to confusion, guilt, and/or disagreements.

As longevity continues to add years to our lives, as the number of divorces for those over 50 continues to escalate, as the number of blended and alternative families grow, and as the number of individuals who decide to remain single increases, the paramount need for having “the talk” grows.

To help you start a conversation about an Advance Directive with your loved one, begin by having “the talk” with your TPC planner. Once you have completed your own Advance Directive, it will be easier to have that talk with a parent, a spouse or partner, or other loved ones.

The personal and societal implications of longevity are challenging. Only by realistically facing your future can you make reasoned decisions about the important issues that affect your financial security. When you’re ready to talk, we’re here to listen.