In light of the recent news around Silicon Valley Bank and in anticipation of related client questions, we’ve put together the following FAQ resource.

Please do not hesitate to reach out to your planner directly with any further questions.

We will be monitoring the situation as it unfolds and will plan to provide updates to clients as needed.

What exactly is going on with Silicon Valley Bank?

Silicon Valley Bank, founded in 1983, is known for being the go-to bank for many start-ups in the technology sector. SVB became one of the nation’s 20 largest banks as many of these start-ups flourished in an era of low interest rates throughout the 2010s and early 2020s.

SVB’s troubles began when the Fed began raising interest rates precipitously in 2022 to prevent runaway inflation. As money became more expensive to borrow, startups began to draw on their cash reserves held at SVB.

To meet these withdrawal requests, SVB had to sell a portion of its long-term debt investments at a loss. These losses spooked certain investors in the venture capital space, who then encouraged the start-ups they advised to withdraw assets from the bank.

As withdrawal requests mounted, it became increasingly clear that SVB would not have sufficient liquidity to meet them all. This led regulators to shut down SVB and take control of all customer deposits.

Please scroll to the end of this post for more detail pertaining to the events surrounding SVB.

Source: NYT

What is the government doing about it?

In addition to taking over SVB, regulators have given assurances that depositors (including those whose deposits exceed the $250k deposit insurance threshold) will be made whole and be given access to their funds as soon as 3/13/23.

This measure is intended to maintain public faith in the banking sector to prevent bank-run contagion from spreading.

Click here to read the recent joint press release from Treasury Secretary Janet Yellen, Federal Reserve Chair Jerome Powell, and FDIC Chairman Martin Gruenberg.

Source: NYT

What impact might this have on the broader economy?

It’s still too early to say, but regulators have signaled that they are willing to do what it takes to minimize any broader impact of the SVB collapse.

It is reasonable to anticipate that global markets may be more volatile than usual in the coming days and weeks until the current uncertainty is resolved. We will be monitoring this situation as it evolves.

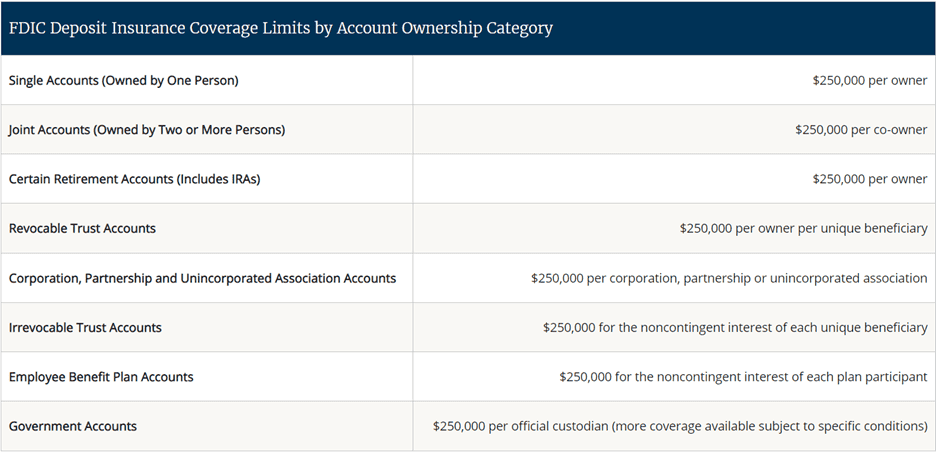

It’s also worth noting that while FDIC insurance covers deposits at banks up to certain thresholds, it does not protect those who hold stock in the banks themselves, nor does it cover investment losses in brokerage accounts more generally.

What do I need to do about it?

If you hold more than $250k at any single bank, we recommend you review FDIC insurance policies (see below) immediately to ensure that you’re fully covered. Your bank is likely receiving lots of these requests and questions right now and should be able to provide you with clear answers and actionable steps to ensure you’re covered.

If you have any questions about your FDIC coverage, your TPC advisor is also here to help.

How does FDIC protection work?

The FDIC provides an excellent summary of its deposit insurance program here. If you hold more than $250k at any single bank, we recommend you review these policies immediately to ensure that you’re fully covered. See the image located at the bottom of this email for further help in understanding FDIC deposit insurance coverage.

What does this mean for my investment portfolio?

This current string of events offers yet another round of evidence in favor of three fundamental risk management principles-

- Asset allocation— When it comes to managing exposure to risk, asset allocation (your portfolio’s breakdown between stocks, bonds, and cash) is the most influential factor. Each investor’s asset allocation should reflect both their willingness and ability to accept risk in their portfolios.

- Diversification—We are reminded once again that it is essential not to have too much a portfolio exposed to any one country, company, or sector. Instead, we seek to diversify risk to the greatest extent possible.

- Discipline—Giving adequate attention to #s 1 and 2 allows us to stay disciplined when markets get choppy. Investors with appropriately allocated diversified portfolios can rest assured that their investment mix is designed to weather the storm and will continue to be rebalanced as needed.

Our belief in the power of these three principles remains steadfast.

What statements have Schwab and Axos made in response to recent events?

You can read Schwab’s statement here. For a more detailed look at the company’s financial position, Schwab’s Monthly Activity Report, published 3/13/23, may also be of interest.

At the time of writing, Axos has not yet released a statement.

What should I do if I’m feeling worried about this?

We will continue to monitor and work on behalf of our clients using the same disciplined strategy we have through other market surprises. Please call your advisor if you’re feeling stress, fear, or anxiety. We are here to talk with you about your specific situation and work with you through this challenge and any challenges to come. We hope you can feel confident, relaxed, and focused on the important things in your life that you can control.

More information on the events surrounding Silicon Valley Bank

Silicon Valley Bank (SVB), a Santa Clara, California institution known for its presence in the tech startup and venture capital community, was closed by regulators on Friday, March 10, and place under the management of the Federal Deposit Insurance Corporation (FDIC). This represents the largest bank failure since the global financial crisis of 2008.

SVB experienced strong growth because of its prominence in the tech industry, reporting $212 billion in assets and $173 billion in deposits at the end of December 2022. But the onset of higher inflation, coupled with the US Federal Reserve’s tightening of credit through higher interest rates, soon began putting pressure on the bottom lines of tech companies, many of which are dependent upon access to credit for continued growth. Because a large proportion of SVB’s business was in the tech sector, the bank began to experience larger outflows of deposits as tech companies—along with the venture capitalists (VCs) who invest in them—pulled funds in order to meet rising expenses.

Last Wednesday, March 8, SVB surprised investors and others with the announcement that it was trying to raise $2 billion in additional assets after selling a portion of its bond portfolio at a $1.8 billion loss in order to cover requests for deposit withdrawals. Partly as a result of this news, shares of SVB fell 60% in value during Thursday trading and another 60% on Friday morning, before trading was halted.

Meanwhile, depositors, many of them startup tech companies acting at the urging of concerned VCs, were withdrawing deposits from the bank at a record rate. By the end of the day Thursday, some $42 billion in deposits had exited the bank. By Friday, regulators had seized control of the bank.

The FDIC has created a new institution, National Bank of Santa Clara, to hold the remaining assets and deposits of the failed SVB. Authorities told the public that the new bank would be operating by Monday morning, March 13, and that insured depositors would have their funds by that time. Deposits in FDIC-insured banks are guaranteed up to $250,000.

Depositors with more than the federally guaranteed amount on deposit face a more uncertain future. Authorities have announced that uninsured depositors will get “receivership certificates” for their balances as well as an “advance dividend” within the week, along with additional dividends funded by sales of bank assets.

Some observers have commented that a principal factor leading to SVB’s downfall was its high concentration of business in a single industry sector. Because the bank was so heavily involved with the tech sector, problems in that sector almost inevitably had an outsized effect on the bank’s profitability. Such difficulties are expected to be less of a problem for larger banks, which tend to be more diversified in their holdings and commitments. Though bank stock prices were dragged down by the news of SVB’s failure in recent trading, at present the particular issues that contributed to the problems at SVB seem unlikely to spread to other banks. Additionally, the more stringent capital requirements put in place in the wake of the 2008 financial crisis are intended to decrease the likelihood that the collapse of an individual bank will have a major negative effect on the banking system as a whole.

One lesson that investors can take away from all this is the importance of diversification to reduce risk from poor performance in any single sector. By building portfolios that are well diversified and in line with our clients’ risk tolerance, we help to smooth out volatility and increase our clients’ opportunities to achieve their long-term financial goals.

Below is an image available on the FDIC website to help account holders better understand FDIC deposit insurance limits.