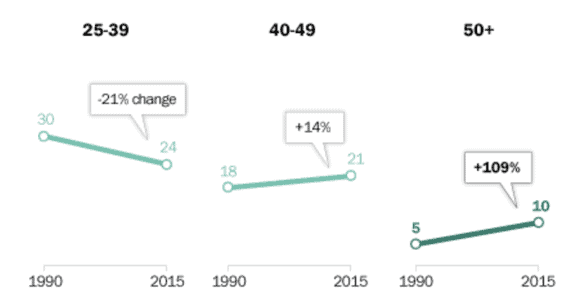

For various reasons, the divorce rate in the United States is falling—except for one important demographic: those 50 and older. Dissolution of marriages that have lasted for 30 or more years is, unfortunately, on the rise, having doubled since the 1990s, according to US Census Data.

Source: Pew Research Center

Naturally, divorce at any age can be an emotionally devastating event. Habits and routines formed over decades of living day-to-day with another person can be knocked out from under both parties; feelings of betrayal, suspicion, and especially fear of the unknown can run rampant.

And as difficult as the emotional challenges can be, couples divorcing in midlife or later often face a special set of financial difficulties arising from the dissolution of the marital union. We have written previously on some of the financial implications of divorce that particularly affect women, and Senior Financial Planner Michelle Maton, CFP®, EA, CeFT® has recently presented a webinar for those trying to find their way through the financial maze that divorce can present.

Larger, More Complex Estates

At this stage in life, one or both parties often have significant assets built up over years of a successful career, and dividing the marital estate can become a complicated and contentious process. In fact, one of the frequent realities of “gray divorce” is that the marital estate tends to be larger and often more complex than for divorces occurring earlier in life. Consideration may need to be given to how retirement plans and other investment accounts can be divided equitably. If one or both spouses have deferred compensation plans, stock options, or other forms of executive compensation, those assets should also be considered, in addition to base salaries. These matters are of particular importance in alimony states. In community property states, it will be crucial to have proper documentation of non-marital property. Inheritances received during the marriage should be carefully reviewed to ensure that commingling has not occurred, since this is a vital consideration in determining the extent of marital property that is subject to division.

Estate Planning Considerations

Divorce, especially in mid-life or later, also may present complications for any estate planning that may have taken place prior to the dissolution of the marriage. Several important questions need careful consideration:

- Is your will up to date with respect to your ex-spouse?

- Are the beneficiary designations on your retirement plans (IRAs, 401(k)s, etc.), any life insurance policies, and annuities appropriate for your new marital status?

- Who is your healthcare proxy? Who holds your power of attorney?

If beneficiary designations are not reviewed periodically and brought up to date with the current wishes of the plan or policy owner, the problem of “unintended beneficiaries” can occur. This happens when divorced persons to discover, when it is too late, that there was an old, forgotten IRA account or paid-up life insurance policy that still carried the ex-spouse as named beneficiary. When this happens, the proceeds will go to the ex-spouse regardless of the terms of the will, because beneficiary designations are not subject to the probate process. For this reason, it is imperative to ensure that these matters are brought in line with your new circumstances.

What about Mom’s—or Dad’s—New Live-In Partner?

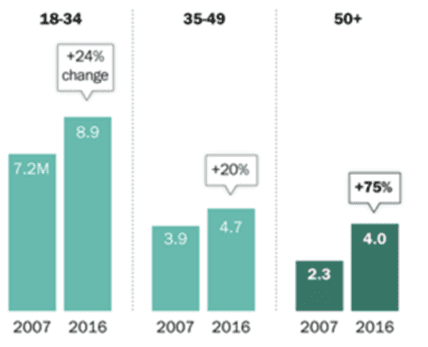

Here we come to a frequent situation in gray divorce that can affect several generations. In addition to the rise in divorces for those who have been married several decades, there is also currently a dramatic rising trend in the rate of non-marital cohabitation among adults 50 and older.

Persons in each age group who are living together in non-marital unions.

Source: US Census Bureau and Pew Research Center

As you can see, the rate of increase is much steeper in the 50+ age group than in any other demographic. And this is the point where the questions can become even more complicated, as adult children and even grandchildren begin to wonder how Mom or Dad’s new partner will affect the plans for their inheritance. An older parent’s new living arrangements can create ripple effects that involve estate planning, healthcare considerations, financial planning, family dynamics, and a host of other considerations.

At the same time, older persons have a legitimate need for companionship and intimacy, and more and more of them are opting for a “live-in” arrangement to satisfy these needs. When this situation arises, perhaps the most important key is open, honest communication around financial matters. A second important principle is to focus on gratitude, rather than financial planning, in these discussions. When everyone comes to the table with a thankful recognition of what has been provided, rather than fear or defensiveness about what might be taken away, discussions tend to proceed much more smoothly and with fewer hurt feelings.

For the cohabiting couple, there are more important questions that should be considered:

- What is your desired division of assets between your new partner and your children or other heirs?

- What is your/your new partner’s tax filing status?

- If you/your new partner own life insurance or retirement accounts, who are the beneficiaries? What about pensions?

- Who will be your primary caregiver if you become incapacitated?

- Are you/your new partner currently receiving Social Security benefits from an ex-spouse? Alimony?

Here again, clear communication is typically the best path to harmony, both for the cohabitating couple and for their children (and grandchildren).

At The Planning Center, we are dedicated to clear, open communication: among our team members and especially with our clients. By asking the right questions and listening carefully to the answers, we are able to help our clients negotiate the sometimes-complicated financial paths that life presents. To learn more about the support we can offer those going through divorce, please visit our website.