Should You Chase Dividend Stocks to Combat Inflation and Rate Hikes?

With inflation at its highest level in decades and the US Federal Reserve raising interest rates, investors may be wondering whether they should devote more of

With inflation at its highest level in decades and the US Federal Reserve raising interest rates, investors may be wondering whether they should devote more of

KEY TAKEAWAYS Soaring inflation and record market highs may leave investors wondering whether it’s time to adjust their portfolios. Researchers have examined a wide range of

GLOBAL DEVELOPMENTS AND THEIR IMPACT Geopolitical events like military or economic conflicts can affect stock markets in many ways. These events are normally widely followed by

KEY TAKEAWAYS National debt is generally a slow-moving variable whose expected value should be incorporated in market prices. The evidence suggests there has not been a

Many investors may think a market high is a signal stocks are overvalued or have reached a ceiling. But they may be surprised to find out

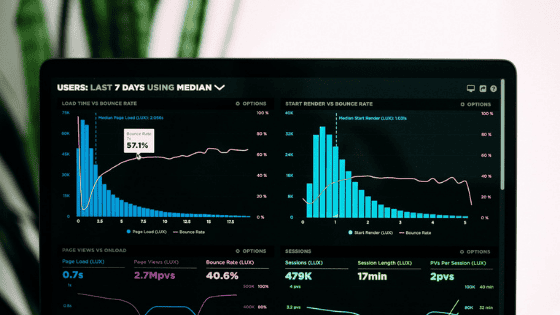

KEY TAKEAWAYS Stock markets continued to climb higher in 2021, with the S&P 500 hitting a series of all-time closing highs and ending the year near

Paul CurleyDirector of Savings Research, ISS Market Intelligence Paul Curley, CFA, is Director of Savings Research at ISS Market Intelligence. He oversees 529 and ABLE market

For investors, it can be easy to feel overwhelmed by the relentless stream of news about markets. Being bombarded with data and headlines presented as affecting

Nearly 30 years after its formal discovery,1 the appeal of stock price momentum2 remains in the eye of the beholder. Some see its outsize historical premium,

KEY TAKEAWAYS Financial journalists periodically stoke investors’ record-high anxiety by suggesting the laws of physics apply to financial markets—that what goes up must come down. But

KEY TAKEAWAYS As interest in ESG investing grows, so too do the ways in which it is measured and reported. ESG ratings providers frequently disagree on

Rebalancing can help investors maintain an asset allocation that aligns with their needs, goals, and risk tolerances. The appropriate approach to rebalancing depends on where an

Stay informed with the latest financial insights from our experts.

ALASKA

310 K Street

Suite 405

Anchorage, AK 99501

FRESNO

7055 N Maple Ave

Suite 108

Fresno, CA 93720

QUAD CITIES

1615 Fifth Avenue

Moline, Illinois 61265

IOWA CITY

136 S Dubuque St,

Iowa City, IA 52240

CHICAGO

303 West Erie Street

Suite 311

Chicago, IL 60654

NEW ORLEANS

1521 Washington Ave.

Suite B

New Orleans, LA 70115

TWIN CITIES

800 N Washington Ave.

Suite 701

Minneapolis, MN 55401

The Planning Center © 2025